Eurozone Outlook – Mind the return of market discipline

Key points

- Meagre Eurozone growth looks set to continue. Supply issues will fade but are unlikely to disappear

- We project euro area headline inflation to land at the ECB’s target mid-2025

- ECB to remain cautious on PEPP roll-off before cutting interest rates during the summer

- Another year of record Italian issuance to add to the ECB’s challenges

Growth: Private consumption push, investment pull

Eurozone GDP growth contracted slightly in Q3 following continued business surveys weakness since the spring. They remain stuck in low gear, implying a technical recession in the second half of 2023 cannot be ruled out. However, we believe a further inflation decline will generate marked real purchasing power gains in Q4 – exceeding 2% above pre-Ukraine conflict levels (Q4 2021) – supporting private consumption. Overall, we project Eurozone GDP to grow by 0.5% in 2023.

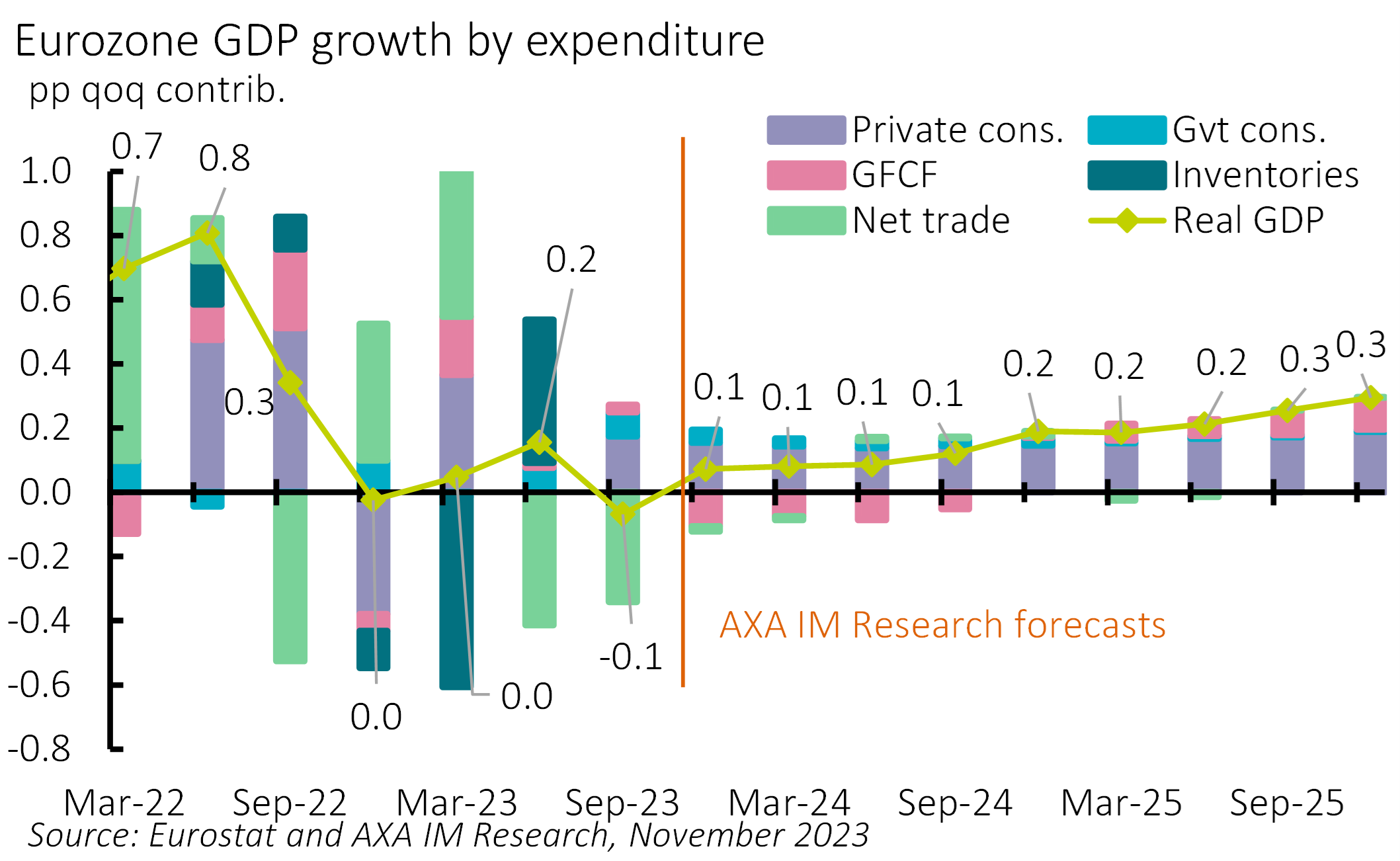

Private consumption is likely to be the Eurozone’s main growth engine for the next couple of years (Exhibit 1) based on expected gains in real purchasing power. Although gradually decelerating from this year’s high plateau (4.5% year-on-year on average), nominal negotiated wage growth should still be decent, averaging 4.0% and 2.8% in 2024 and 2025. Combined with gentle labour market cooling, it should fuel further real income gains as inflation decelerates further. Consumers have maintained higher savings post-pandemic. We maintain a cautious stance projecting 1.1% and 1.2% private consumption growth over the coming two years.

We think investment is likely to become a drag on GDP growth. The historical relationship between construction activity and mortgage lending suggests further downside to residential investment. Assuming a normalisation in non-financial corporations’ profit margin behaviour, further meaningful increases in real interest rates (mainly linked to the inflation fall) are likely to take their toll on business investment. That said, we think the correction is likely to be more limited than historical relationships suggest owing to ongoing fiscal support – mainly the Next Generation EU (NGEU) recovery programme – a weak but not abysmal demand signal; and that non-financial corporations’ and banks’ financials are in better shape than in previous downturns. We expect overall investment to dip in 2024 (-1.1% on average) – though not crashing – before recovering in 2025 (+0.5% on average) (Exhibit 1).

Events since COVID-19 have highlighted the need to identify the relative importance of supply and demand factors affecting the economy. This daunting task is to continue. For the next couple of years, we think supply issues should fade somewhat – though are far from disappearing - but demand is likely to be the most important factor affecting the euro area economy, barring any new shocks.

All in all, we keep our subdued, though improving sequential growth forecasts, projecting the euro area economy to grow by an uninspiring 0.3% in 2024, before edging up to 0.8% in 2025 – still below potential growth. A weaker demand backdrop is consistent with a mild rise in the unemployment rate, projected to increase from an average of 6.5% this year to 6.9% in 2024 and 7.3% in 2025.

Exhibit 1: Private consumption – the main engine of subdued growth

Inflation: 2% likely but only in mid-2025

Eurozone headline inflation surprised to the downside falling below 3% in October for the first time since July 2021. However, we think the road to 2% will take more time than the last five months that saw inflation halved to 3%. Energy base effects are the main reason for the end of this recent disinflationary trend. Food and core price disinflation look likely to continue, though at a slow pace. In turn, we expect headline inflation to be volatile between 2.5% and 3% throughout 2024, crucially not starting a further downward trend before the beginning of 2025, when it will react to softer wage growth and labour market easing. We see the European Central Bank’s (ECB) 2% target being hit mid-2025.

Overall, we expect euro area headline inflation to come down to 2.7% and 2.2% in 2024 and 2025 after 5.5% this year. The slowdown in core inflation is likely to be more limited, edging to 3% in 2024 from 5.0% this year. We project it to remain above 2% throughout 2025, averaging 2.3%. This will likely keep the ECB in a vigilant mode.

ECB: A challenging policy sequence

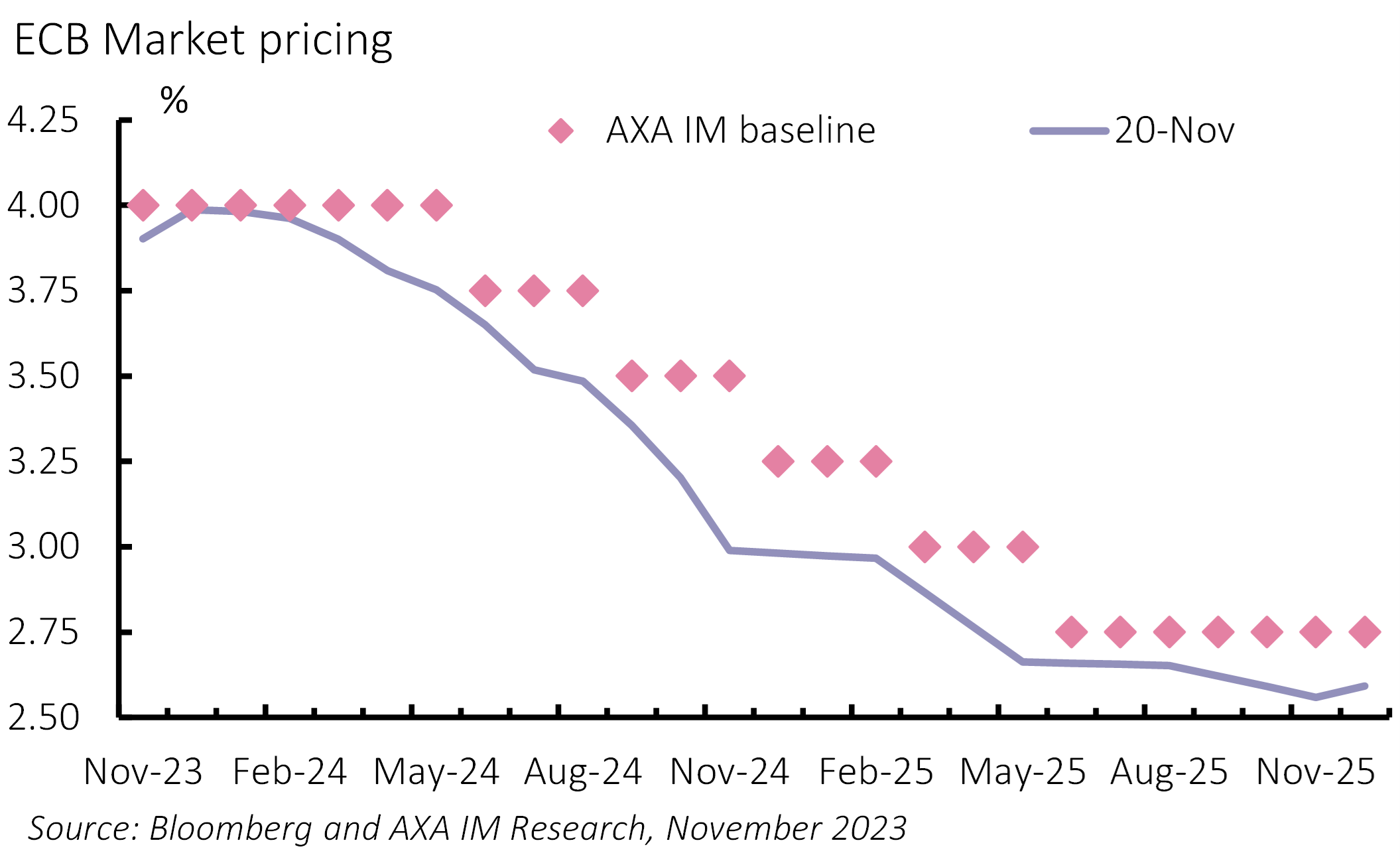

Given the backdrop of recession-avoiding low growth, with fading but still present supply constraints, and inflation resistant to a fall to 2%, the ECB’s hawkish tone is likely to continue. Though we maintain that ECB’s deposit rate has likely peaked at 4% but will remain unchanged until next summer.

Policy decision-wise, the ECB’s balance sheet will be next to come into focus, and especially Pandemic Emergency Purchase Programme (PEPP) reinvestments. This is likely to be a difficult topic given they are the first line of defence against financial fragmentation and next year’s sovereign gross issuance is set to be very high (again).

We expect the ECB to proceed carefully, mimicking its approach with the Asset Purchase Programme (APP): Not withdrawing support during Q1 2024 when gross issuance is seasonally high and then setting on a gradual and predictable non-reinvestment pace. We expect a decision this winter, March seeming more likely than December, and will in any case be dependent on market conditions. We expect a partial roll-off of PEPP to start in the second half of 2024. A decision in March may also come alongside the operational framework review which would put the ECB in a good place to tackle the (excess) liquidity topic in a comprehensive fashion.

Both the ECB’s Chief Economist and President have highlighted the importance of ongoing wage negotiations, with data to be published next spring. Confirmed decelerating wage pressures – amid our predicted volatile 2.5%-3% inflation path during 2024 – would reassure the ECB on its path towards its inflation target. Unit labour cost dynamics and inflation expectations will also be key inputs. Persistent supply issues will make forward-looking approaches difficult.

Owing to our below consensus/ECB growth forecasts, we expect the first ECB rate cut to come next June - 25 basis points (bp) a quarter until June 2025 to 2.75% – but as with rate increases, the ECB is likely to be sensitive to the Federal Reserve (Fed). History would suggest a slight delay (a minimum of four months), which given our June baseline for the Fed makes a cut in September a very reasonable option, which may also be justified in the case of slower-than-projected labour market cooling, especially with regards to unit labour costs. Both argue the market has got ahead of itself again in pricing a first cut in April (Exhibit 2).

Italy: Beware of market discipline (again)

With policy rates set much higher than thought, spring banking stress and record net issuance, sovereign bond markets behaved surprisingly well until the sell-off over the summer. Complacency into 2024-2025 may come at a high price.

More than a year into office, the Italian government’s stability is remarkable, unlike other countries e.g., Spain, Portugal and the Netherlands – all forced to endure snap elections. However, we do not think the coming years are likely to be plain sailing.

We forecast Italy to underperform the big four Eurozone countries, projecting 0%/0.5% growth in 2024/2025, affected by contracting investment, resulting from monetary policy tightening (but also a past boost in the construction sector). Meanwhile, it is hard to disentangle it from Germany’s manufacturing woes, and more generally tepid global growth. Our growth projections for Italy are far below those of the government (1.2%/1.4%) implying some budget slippage on an already challenging public debt trajectory. Also crucial for medium-term fiscal sustainability, NGEU funding implementation has yet to pick up to cruising speed.

Furthermore, we estimate that Italy’s 2024 government net-net issuance (net of the ECB’s reinvestment) will be around €50bn higher than this year. Retail absorption played a crucial part in this year’s government funding, but it is not only uncertain that it can be tapped again to a similar extent, let alone increase participation. This leaves 10-year government bonds – BTPs – (levels and spread) vulnerable to domestic factors but also global rate dynamics. Again, a fine line for the ECB to walk, pending clarity on future fiscal rules.

Exhibit 2: Market rate cut pricing on the aggressive side

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.