Investing in a sustainable future: Sustainable ecosystems

Green bonds are financial instruments designed to raise funds for projects that deliver positive environmental impacts.

Key facts and trends in Nature & Biodiversity

Nature & Emissions

12-15% Global GHG emissions come from land use, land-use change, and deforestation1. This includes peatland degradation and soil carbon loss.

Biodiversity Loss

50% Global GDP depend on nature4

- Nature & biodiversity provide essential ecosystem services that our economies depend upon.

- Its loss can undermine ecosystem functioning and resilience, posing risks to food security, water systems, health, and the economy.

- One of the most transgressed planetary boundaries, it has no clear tipping point - meaning damage could be irreversible and nonlinear.

Nature & Climate are Intertwined

Nature & Biodiversity contribute to climate change via emissions but are also vital to mitigation by acting as essential carbon sinks > Climate Change is 1 of the 5 drivers of biodiversity loss5

The road to net zero by 2050

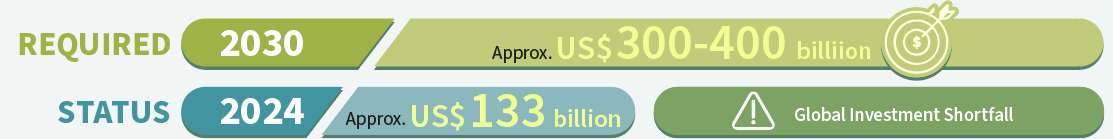

To reach Net Zero by 2050, approximately US$300-400 billion annually by 20302 is needed to effectively protect and restore ecosystems, conserve biodiversity and enhance carbon sequestration. Solutions are needed beyond conservation and restoration, in areas driving nature loss like pollution and overexploitation of natural resources including water. In 2024, funding for nature-based solutions reached about US$133 billion3, suggesting a funding gap of at least US$167 billion.

Where do green bonds fit in?

Sustainable Ecosystems

Eligible Projects Financed

- Biodiversity conservation infrastructure and monitoring systems

- Ecosystem protection and restoration

- Sustainable forest management including reforestation

- Sustainable agriculture projects

- Sustainable water and wastewater management

- Waste prevention, reduction, and recycling infrastructure

Case study

New Zealand - A commitment to the environment

New Zealand is at the forefront of environmental stewardship, with ambitious goals to reduce emissions by 50% by 2030 and achieve net-zero emissions by 2050, excluding biogenic methane. Their Green Bond Framework directs funds into projects that support both climate action and nature conservation, reinforcing the country’s commitment to the Aotearoa New Zealand Biodiversity Strategy, which aims to reverse biodiversity decline by 2050.

Biodiversity is a key focus for New Zealand, as many native species are under pressure from the ongoing impacts of invasive species, changes in land and sea use, direct exploitation, climate change, and pollution. With over 80% of native species found nowhere else in the world, the preservation of this unique biodiversity is crucial for maintaining the ecological balance and cultural identity of the country.

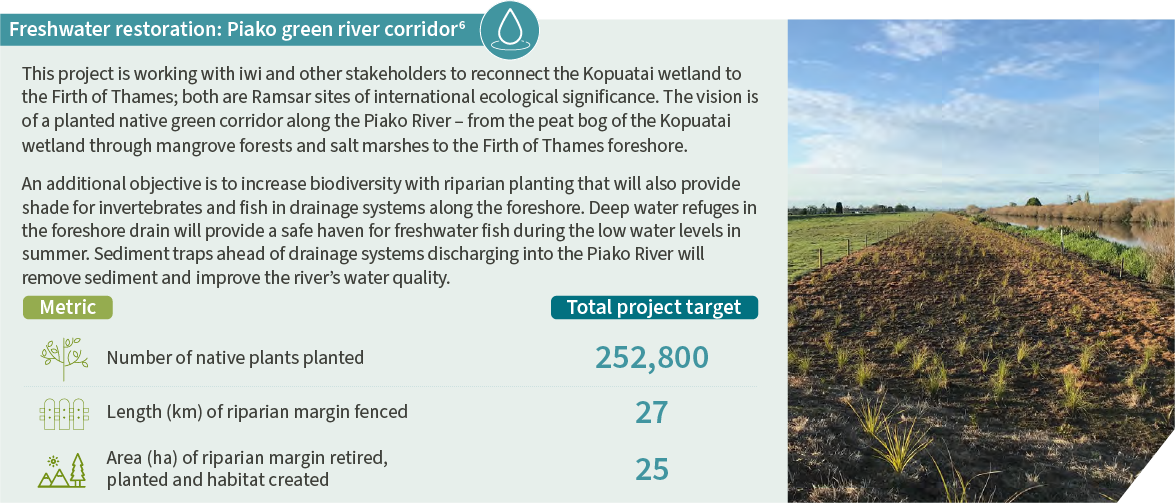

One significant initiative funded through this framework is the Piako Green Corridor, which aims to restore natural habitats, promote cultural recognition, enhance community employment, and build resilience against flooding. This project exemplifies New Zealand's dedication to preserving its unique natural heritage while fostering local employment and cultural recognition.

Green bonds are one of the most appropriate debt instrument to accompany issuers committed to transition to a more sustainable environment. It supports the protection of ecosystems, restore natural habitats and promote sustainable land and resource use. Contact us to explore more!

Sources:

[1]Source: United Nations Climate Change Introduction to Land Use | UNFCCC

[2]Source: The Wall Street Journal Safeguarding Natural Capital: How Banks Can Work with Indigenous Peoples - WSJ

[3]Source: United Nations news Global biodiversity agreement mobilises US$200 billion boost for nature | UN News

[4]Source: Nature Risk Rising |World Economic Forum

[5]Source: Global assessment report on the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services |IPEBS.

[6]New Zealand Debt Management - New Zealand Soverign Green Bond Allocation and Impact Report 2024

Disclaimer

Companies shown are for illustrative purposes only as of 31 August 2025 and may no longer be in the portfolio later. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute an other to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Not for Retail distribution: This document is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

In Australia, this document has been issued by AXA Investment Managers Australia Ltd (ABN 47 107 346 841 AFSL 273320) and is intended only for professional investors, sophisticated investors and wholesale clients as defined in the Corporations Act 2001 (Cth).

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.