Investing in a sustainable future: Sustainable transportation

Green bonds are financial instruments designed to raise funds for projects that deliver positive environmental impacts.

Key facts and trends in transportation

Transport Sector

16-18% Global GHG emissions

Including road, rail, aviation and shipping1.

Breakdown of transport emissions:

- Road transport: 72%

- Shipping: 10%

- Aviation: 11%

Emissions Trend

- Emissions have grown steadily over the past decades, approximately doubling since 1990.

Without stronger policies and technological shifts, transport emissions are projected to increase by 30-40% by 20501. - Urbanization and rising incomes in developing regions will further increase transport demand, emphasizing the need for sustainable infrastructure planning.

The road to net zero by 2050

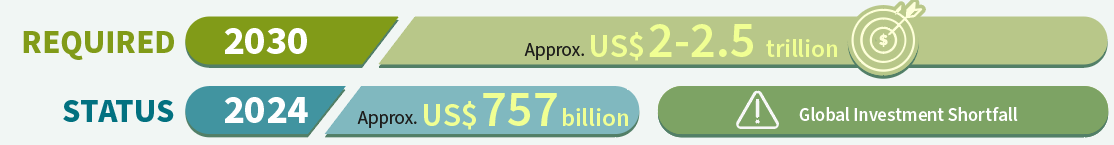

To reach Net Zero by 2050, approximately US$2-2.5 trillion is required annually globally by 20302. This includes investment in electric vehicle infrastructure, public transport, and rail electrification. In 2024, global investment in electrified transport reached a record US$757 billion3, suggesting a shortfall of about U$1.7 trillion.

Where do green bonds fit in?

Clean Transport

Eligible Projects Financed

- Rail network electrification and expansion

- EV charging infrastructure and battery manufacturing facilities

- Electrification of public transport fleets

- Urban transport infrastructure supporting active mobility

- Low-emission port infrastructure and shipping electrification

projects

Case study

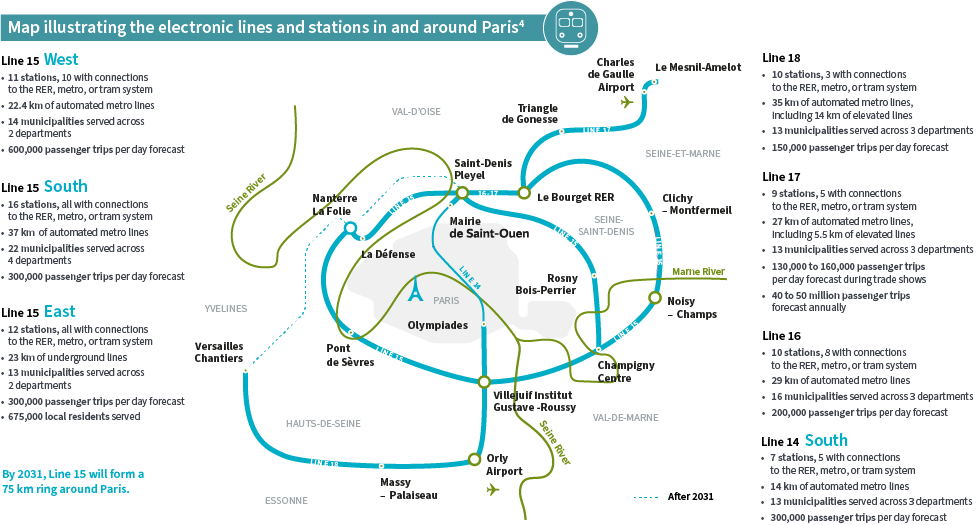

Société des Grands Projets - A Metro for the Future

The Société des Grands Projets (SGP), a French state-owned company that provides transportation and infrastructure construction services in the Paris Metropolitan Area, is leading the change toward sustainable urban transportation. The Ile-de-France Region, incorporating the Paris Metropolitan Area, is France’s largest urban area, with a total carbon footprint of 38.5 million tonnes of CO2e, in among which 60% is related to the transport sector.

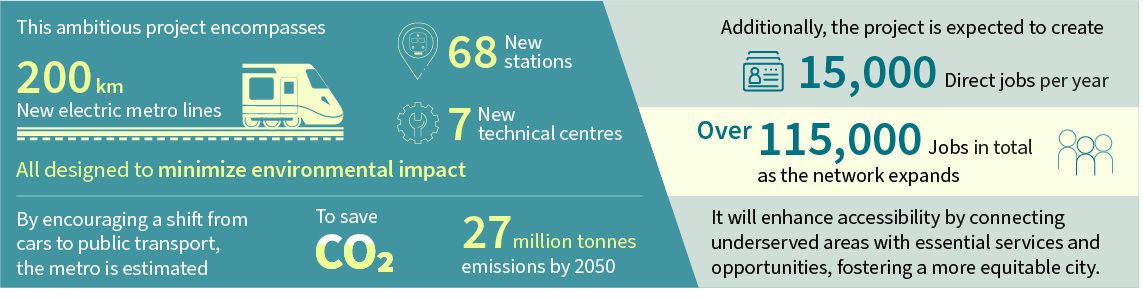

Committed to achieving net-zero emissions by 2050, SGP is constructing the Grand Paris Express—a new automated electric

metro network that represents a robust substitute for automobile use, accommodating over 2 million passengers daily. Capital expenditures related to this project and financed through the green bonds are fully aligned with the EU Taxonomy, complying

with stringent criteria.

The new metro lines will also connect underserved suburbs with job hubs, universities and hospitals, contributing to reducing geographic inequalities in public service access.

Green bonds are one of the most appropriate debt instrument to accompany issuers committed to transition to a low carbon economy. It supports the decarbonization of the energy sector by channeling capital towards projects that reduce GHG emissions and provide investors with a higher level of transparency and measurability. Contact us to explore more.

Sources:

[1]Source: IEA’s World Energy Investment 2023; IPCC AR6

[2]Source: SLOCAT Transport and Climate Change Global Status Report (2nd edition)

[3]Source: BloombergNEF report, Global Investment in the Energy Transition Exceeded US$2 Trillion for the First Time in 2024, January 30, 2025

[4]Source: Societe des Grands Projets' Green Bond report 2023 (UK)

Disclaimer

Companies shown are for illustrative purposes only as of 31 August 2025 and may no longer be in the portfolio later. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute an other to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Not for Retail distribution: This document is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

In Australia, this document has been issued by AXA Investment Managers Australia Ltd (ABN 47 107 346 841 AFSL 273320) and is intended only for professional investors, sophisticated investors and wholesale clients as defined in the Corporations Act 2001 (Cth).

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.